This can be found under Miscellaneous Forms in the State Section.įrom Client Search select the client you need to create the extension for You will need to create the extension within the state return and mark it for electronic filing. In order to create extension for states, you must create the return and the state return. Since the application is sent electronically, we recommend sending the application a couple of days before the due date to give the payment time to process.

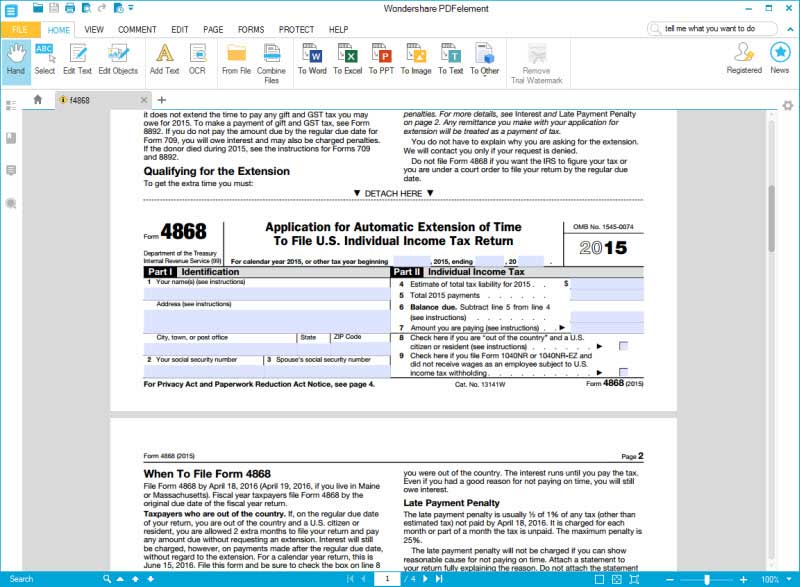

Electronic payment requests may be sent with the extension in order to help the taxpayer pay their required taxes online. To be considered timely paid, the IRS must receive the taxpayer’s payment on or before the April 15th due date. Even if the extension is filed, if payment is not received by the deadline the taxpayer may still incur interest and penalties associated with late payment. Filing Form 4868 only extends the time a taxpayer has to submit their income tax return to the IRS, it does not extend the time the taxpayer has to pay any amount that may be due. While the normal due date for taxes is April 15th ( during most tax years), Form 4868 extends the due date by 6 months to October 15th. If taxes aren’t paid by the April tax filing deadline, interest and penalties will be charged, accruing from the original due date, even if an extension was filed.Creating, Printing and Filing Extensions in ProWebįorm 4868 is used to extend the time to file an individual tax return.

To get the extension, you must submit Form 4868 by the April tax filing deadline.įiling the IRS extension form doesn’t give you more time to pay taxes. This will give you an automatic extension of time to file.įorm 4868 is short, comprising just a few boxes and lines, but it comes with four pages of instructions and information.įorm 4868 gives taxpayers a six-month extension to file federal tax returns.Īn extension for income tax returns due on 15 April would give you until 15 October to file. You can avoid filing Form 4868 if you make an electronic payment to the IRS for some or all of what you think you will owe. Most years, tax payments are due on 15 April, even if you get an extension to file your return. It is called the ‘Application for Automatic Extension of Time to File’, and filing gives you an extra six months to prepare and submit your return. Form 4868 is an official request to the IRS for an ex tension of time to file your tax return.

0 kommentar(er)

0 kommentar(er)